Monday, 29 June 2009

Macro notes

In the macroeconomy leakages equal injections. Leakages refer to the circular flow where money is not used for further investment, it comprises government expenditure, net imports, and savings. To see this, governments have to spend money on hospitals, roads, police, defence etc. households have to save money they don’t spend, the country buys products it cant produce cheaply from abroad. In each case the money goes out.

In the circular flow the output is equal to consumption + investment + government expenditure + net exports =Y. the inputs a firm receives equal the firms output, that is every money a firm receives it pays to people as wages.

The chapter is basically about how to calculate gdp, this is in the region of $7500 bn, nearly a tenth of a $tn. There are three approaches to measuring gdp, the expenditure approach (preference) , factor income approach, and the value added approach. I know about double counting, it’s counting the same value added twice. For example, a baker buys flour, the farmer has added value, a consumer buys a loaf of bread, if you add the value at each stage you count the farmers valued added twice.

Gdp is a big number, it is the aggregate of goods and services provision, actually two thirds of gdp is consumer expenditure on goods and services. A consumer expenditure on goods and services are food from the supermarket and a haircut from the barber.

Price level and inflation

Inflation is the average change in prices, it is an increase as deflation is the average fall in the price level.

Inflation is measured in two ways; the CPI (consumer price index) (preference) and the GDP deflator. Both measures give a very similar, but not exactly the same result. Both measures also suffer from upward bias, in the region of 2-3% a year. Upward bias happens for 3 reasons; new goods, increases in quality and substitution. To understand these three reasons it is first necessary to know the general idea behind calculating inflation. The method is to take the price and quantity of goods in one year, and the new price and new quantity of the same goods in the next year, by using a formula it’s possible to calculate the percentage change. Now it’s possible to explain the three reasons listed above. Firstly, new goods. In the time period of a year new goods are created, and so the original basked of goods used has to be updated to include the new goods, because the original basket might include for example a cd walkman and a tv (non flat screen), after a year there are new goods; the mp3 player and the flat screen tv. As mp3 players and flat screen tvs are more expensive this creates the upward bias. Second reason; increased quality of goods, during a year the quality of goods increases, for example a new, revised edition of a text book, a computer with faster components and more disk space, most often higher quality increases the price so there is an upward bias. Third; substitution, the basket of goods changes because consumers change where they shop to get more bargains, for example people go to discount shops and buy discount air plane tickets online. This overstates the effect of a price change.

GDP if far from being a perfect measure of the economy of a country. GDP doesn’t include the pleasure from taking time out of work to enjoy ourselves nor does it include the productive activities we do everyday in our homes, such as cooking, cleaning, teaching our family new things.

The gdp omits illegal activites such as drug selling, child slave labour, and this counts for between 9 and 30% of gdp, and even more in some countries.

The value of an hour spent in leisure must be higher than the value of the last hour I worked, otherwise I would continue working.

The way the imf and worldbank measure gdp presents a distorted picture of economies. How rich are countries really? If by changing the type of way to calculate gdp results in wealth per person becoming six times larger. Purchasing power parity takes into account how many good you can actually buy with your money.

Gdp fails to measure things that have an important effect on our wellbeing and lives in general. The right to vote, the freedom of speech and expression don’t get measured by gdp.

A stock is something that is built up and stored. A flow is something measured during a period of time that adds to the stock. Gdp is a stock and investment is a flow that contributes to the stock. Wealth is a stock and saving is a flow that increases wealth.

Aggregate expenditure is composed of consumption on goods and services, investment, government spending, and net exports.

Aggregate income is composed of wages paid by firms to households.

All expenditure goes to firms who pay it all out in wages to households.

Governments spend money on roads, police, nhs, defense, and government receives money through taxing people. Transfer payments from government to people in the form of unemployment benefit, child care benefit.

Injections equal leakages. Leakages are saving, taxes, imports, injections are investment, government expenditure and net exports.

Inflation

Unanticipated inflation has costs on the labour market. When people anticipate inflation they decide to get higher paying jobs and to re negotiate salaries to get higher salaries. The data must show a relationship between inflation in some period and an increase in the bids for higher wages in some period that is before the period. Redistribution of income is one cost; when unexpected aggregate demand creates inflation the employers gain over the workers. This is because the inflation has not been anticipated at all, wages are low but prices are high so the firms profits are high. On the other hand if aggregate demand is expected to rise but it doesn’t the employees gain over the employers from the redistribution of income. Wages are high but prices remain as they were so firms profits are low.

Anticipated inflation effects the level of employment through the real wage rate. The real wage rate is the wage rate that takes into account inflation. If firms don’t anticipate inflation but inflation occurs the real wage rate falls, firms try to hire more labourers to increase production to maximise profits but new workers aren’t attracted as the real wage rate is too low, the firm pays overtime to existing workers to increase production, at higher levels of production the firm incurs more costs of machine maintenance and repairs. Some workers leave the firm because the real wage rate has fallen and try to find jobs that offer the original wage they received before the inflation set in. the workers looking for new jobs thus incur job search costs as it takes some time to find new jobs.

What if people anticipate inflation but it does not occur? In this case the real wage rate is too high and the firm makes redundancies so the level of unemployment rises. The level of output of the firm and thus its profits fall.

The capital markets are affected by anticipated inflation. There are redistributions of income between lenders and borrowers of money. When unanticipated inflation occurs the interest rate is too low to sufficiently compensate lenders for the falling value of money, so borrowers can get money quite cheaply because interest rates are low hence borrowers gain at the expense of lenders; on the other hand when inflation is anticipated but it does not occur the rate of interest is set too high and lenders gain at the expense of the borrowers. Thus it is prudent to conclude that there are incentives for borrowers and lenders to anticipate inflation correctly.

Whether or not inflation is correctly anticipated has implications for the costs faced by lenders and borrowers. If the inflation turns out to be lower than expected the lenders will want to lend more and the borrowers will want to borrow less, on the other hand if inflation is higher than expected the borrowers wish they had borrowed more and the lenders wish they had borrowed less.

People use all available information to make forecasts of future inflation rates, people are assumed to form RATIONAL EXPECTATIONS that means that the expectations are correct on average, sometimes they are wrong, and the expectations take account of all available relevant information.

decision making

People make around 221 food related decisions pe day according to a study by Brian Wansink in the January issue of Environment and Behavior. When people were asked how many decisions a day they made on food they said 15, but tests show it is more like 221 because of a large, wide range of decisions e.g. when to eat? How much to eat? What to eat? How much to spend on food? Where to get food? Where to eat? How to cook it? What not to eat? What cutlery to use? How to cook? What plate to use? How to clean up after eating? To eat with a knapkin or not? How many times to chew? What size to cut food to? The more you think about it the more mind boggling it becomes and the more detailed decisions you can think. Like, what colour plate to use? What position to sit in when eating? Whether to watch tv or listen to the radio or read a book whilst eating? Whether to count calories? The point is there a huge numbers of decisions being made, and in economics the most important decisions are analysed, for example to decision to work or not, the decision to spend money or not, how to pay for a new business? What policies to follow to help the poorest countries in the world come out of poverty? What to sell? How much to sell it for? Who to sell it to? The most famous text book in economics defines economics as the study of the choice of what, how and for whom to produce. (begg)

I think the way economics should be studied is to divide up the key decision areas into distinct groups and then focus on each group separately whilst studying possible links between the groups, for example decisions should be separated into areas like labour markets (getting jobs), business finance, decisions made by individuals (micro), decisions made by large groups of the same people (macro), economic growth, policies, and etc.

The next critical question to answer is how to go about studying economics- well first data needs to be collected which involves making observations of the real world and recording them using precise and effective methods. The data needs to be organised and any unreliable data needs to be discarded. The data needs to be analysed in relation to something else to find out relationships so theories can be formulated, for example data on decisions about how much to eat could be tested against the price of food to see if one effects the other, this is done by holding everything else constant, ceteris paribus, which means to ignore but not forget the important influence of other factors on a variable, variables are observations that change when another observation is changed, they vary, for example as food price goes up people eat less because they cannot afford as much food. When we know what causes the variable in question to change we can better understand how different decisions effect each other and from this we can make predictions about decisions. One could predict that a rise in food prices that leads people to eat less could eventually lead to starvation of people if the prices rise extremely high because no one can afford to eat, so there must be something that keeps prices from rising so high, like laws and institutions, because people do afford to eat as not everyone is dead from starvation. We also know that if food prices are too low people eat too much and get fat and become ill and go to hospital and the hospital becomes full and taxes are raised to pay for more beds and doctors. These predictions are very powerful. By knowing this the government can implement laws to stop food sellers from exploiting peoples need to eat and this prevents us from eating everything and us all starving. Maybe some readers believe this is not true but it is based on reliable data collected from the real world and the reasoning used has been correct so the conclusions drawn must be the truth, admittedly this is not perfection, we say ceteris paribus but what if other things do have an influence and we don’t know about them? This is a valid point but everything has its limitations and economics does the best with what it has, in fact it does a very good job, admittedly some economics is better than others but I believe the field of economist is strong and full of hard working researchers and students who are making the science of economics better as we speak.

What we have been talking about so far is positive economics as it is about “what is” but economics also uses value judgements “what ought to be” type statements. These types of judgements are not able to be proven, it is not like the price rise in food means people buy less food, these are value statements based on what society values, for example, the government should provide poor people with extra money so they don’t have to sleep outside without warm clothing. Indeed, many economists have made some very convincing arguments using normative economics. This may be because people make decisions on values of society, so in essence it is just as important as positive economics.

I think the best economics comes from studying relationships in as much detail as possible and by using data that is irrefutable as this proves to other people that it is the truth and that wild assertions can indeed be backed up by data. As long as economists keep in mind it is a science about decision making and don’t try to mix it up with other sciences then economics should progress as best as it possibly could. It is true that thoughts of unrelated things that enter into the study of economics only seek to cloud the economists judegement as two sciences shouldn’t be mixed as economics on its own is powerful enough. Its true that all sciences share some common methods, like analyzing data, using graphs, taking real world observations, making theories, studying other scientists in the same field, writing essays, a love of understanding of the world, wonder at the universe, and etc.

Sometimes you read an essay in economics and it is hard to understand and it is like reading another language, this is a pain for all economists as it makes studying the subject harder and it puts off some people from becoming economists. The problem stems from the fact that many authors in economics are indeed not English, their mother tongue is not English, and so they write in English as a second language and not a first language, they have learnt English for a limited time and their ability in it is limited, also the other point is that economists don’t want to keep writing about decision making but they have to so they write about decision making but re phrase it so they don’t use words like decisions all the time as this would make their essay rather repetitive, boring and not good, but rest assured they are meaning decisions even though it is not explicitly stated. One other thing is that mathematical models put people off but economics cam be studied just as effectively using verbal descriptive methods so descriptive essays can be read instead of mathematical papers without any loss in value.

Economics has its own language in the sense that it uses exotic sounding terms like credible threats, regret theory, expected utility theory, dominated strategy, capital deepening, capital intensity, certainty equivalent, choke price, collusion, conglomerate, cyclical unemployment, sales tax, speculative demand, spot market, future market, stock, strip financing, structural unemployment, stylised facts, sunk costs, supply,

Capital deepening- an increase in capital intensity

Capital intensity- the amount of capital input per labour input

Certainty equivalent- the amount (money or utility) a person is willing to receive in order to be indifferent between taking a gamble and accepting the sure thing

Choke price- the lowest quantity demanded for which the price is zero

Collusion- where parties refrain from partaking in an activity they usually would in order to reduce competition and raise prices

Conglomerate- a firm operating in several industries

Cournot duopoly- a pair of firms that split the market

Cyclical unemployment- when the unemployment rate moves in the opposite way to the gdp growth rate, for example the gdp growth rate is high and the unemployment rate is low

Sales tax- a tax levied on the sale of a good or service which is usually proportional to the price of the good or service

Sharpe ratio- it is the mean minus the risk free rate multiplied by the standard deviation for an asset portfolio. The nyse has a sharpe ratio of .3 to .4. standard deviation measures risk and mean measures return. Higher sharpe ratios are more desirable.

Speculative demand- the speculative demand for money is inversely related to the interest rate

Spot market- a market where good or services are traded for immediate delivery

Future market- a market where goods and services are traded for delivery in the future

Stock- a portion of ownership in a company that entitles the own to the companies profits (aka equity or share)

Strip financing- this is corporate finance where securities are sold in a stapled package and cannot be sold separately. This is useful because people with the same interest are all in one group so it is less likely there are conflicts of interest.

Structural unemployment- a form of unemployment that results from there being zero demand for workers that are available

Stylised facts- real world observations that have been made in so many contexts that they are considered economic truths, these are essential for theory building as the theory must fit the stylised facts, but stylised facts or of no use in economic history because context is required to be specific.

Irrevocable- incapable of being revoked

Sunk costs- costs that are not able to be revoked and should not influence current decisions

Supply- the total quantity of a good or service that is available at a particular price

Demand- the quantity of a good or service that a consumer is both willing and able to purchase at a particular price

Tuesday, 6 January 2009

Social hell

“Many people labour in life under the impression that they are doing something right, yet they may not show solid results for a long time. They need a capacity for continuously adjourned gratification to survive a steady diet of peer cruelty without becoming demoralized. They look like idiots to their cousins, they look like idiots to their peers, they need courage to continue. No confirmation comes to them, no validation, no fawning students, no Nobel, no Schnobel. “How was your year?” brings them a small but containable spasm of pain deep inside, since almost all of their years will seem wasted to someone looking at their life from the outside. Then bang, the lumpy event comes that brings the grand vindication.

Or it may never come.

Believe me, it is tough to deal with the social consequences of the appearance of continuous failure. We are social animals; hell is other people.”

Sunday, 4 January 2009

rate of returns to education

The draft lottery (p.251 borjas)

An experiment for returns to education was performed using

[1] Angrist, j. and Krueger, a. “estimating the payoff to schooling using the vietnam-era draft lottery” national bureau of economic research working paper no. 4067, may 1992

Saturday, 3 January 2009

school quality

According to David Card and Alan Krueger:

"Thirty years after the Coleman report, it is unfortunate and frustrating that

more is not known about schooling. While most of the literature on test scores

points to little, if any, effect of school resources, some observational studies and

one actual experiment have found a connection. Decisions about educational resources

and reform have to be made in an environment of much uncertainty."

The full paper that this conclusion was from can be found here http://links.jstor.org/sici?sici=0895-3309%28199623%2910%3A4%3C31%3ASRASOA%3E2.0.CO%3B2-L

Wednesday, 31 December 2008

issues on the xbox 360

In order to play Halo 3 on my xbox 360 i had to create a profile. i was playing offline so i created an offline profile. the profile is basically an id and a record of gamer facts relating to my xbox games. so when i play halo 3 my offline profile records my in game achievements and various stats relating to the game. after playing for about 10 hours i decided to give xbox live a try. xbox live is like everything xbox over the internet. in order to access xbox live i had to create an online profile, so i created my online profile but little to my knowledge the halo 3 save game files hadn't been transferred across to my new online profile and so i would have to start from scratch! what a waste of time! there should be a way of transferring save game files from offline profiles to online profiles but there isn't as it doesn't exisit and i've looked on google for a way to do it but my searches were fruitless. readers who are unfamiliar with xbox gaming should realise that by gaining achievements by completing the games various stages unlocks rewards that go towards my profile.

let me digress for a moment, one letter costs £5! as you can imagine when creating a gamer tag name for yourself on the xbox 360 requires you to be quite original in your choice, given that there are millions of gamers its pretty hard to find a name that hasn't already been used, and xbox wont allow the same name to be used twice. after discovering my first 10 names were already used by other gamers i rather joyishly stumbled upon a name that no one had used, it was "chaotic komodo" , although at the time i hadn't realised that i had spelt it like "chatic komodo" so i proceeded in all my ignorance and completed my online profile. as soon as i had completed it i realised the spelling mistake, and so i immediately set about going to change it, but much to my horror to change the spelling mistake would cost me about £5 in gamer credits. now let me briefly explain what these gamer credits are, xbox operated an online market where people can exchange cold, hard money with online gamer credits which can then be used to purchase things in the xbox market place, such as game add ons, games, films, music etc. so i decided that one letter was not worth £5, and i was quite annoyed that microsoft were being so harsh in punishing me for an innocent spelling mistake, they sure think of the wierdest way to screw you out of some honest cash.

what should microsoft do next for the xbox 360?

microsoft should address the issue that people from other countries regularly play together but cant understand each others language. my proposed solution is to use speech recognition inter-language translation software essentially built into the microphone interface. see that language barrier fall! see it!

the economics of xbox 360 purchases

my advice for consumers in norwich is to buy xbox games from gamestation which can be found in the castle mall two shops down from zavvi (rip). you can get halo from gamestation for £10 when bought with another game such as elders scroll: oblivion iv. in zavvi halo 3 on its own is about £30! in hmv its over £20!

sellers of xbox 360's operate mixed bundling and product differentiation strategies to make maximum profits. the way bundling works is that xbox 360 consoles are sold with games for a price that is less than selling the games and console separately. the down side to this bundling is taht consumers dont have much choice over the games that come in the bundle, and so some people may be put off a particular bundle because of the games. the bundles are formed by complimentary products in the sense that games are a complimentary product for xbox 360 consoles. in most cases people find that buying a console on its own is just the same price as buying the exact same console bunled with some games, so people buy the console even though they have no desire to own the games that are bundled with it.

at first glance it may seem that there are in fact 3 different xbox consoles, but they are in fact just slightly different versions of the same product. the main difference between the consoles is the memory, the arcade version comes with 256mb, the pro version comes with 60gb and the elite console comes with 120gb.

Monday, 15 December 2008

CIA economics

The CIA has a sort of economy of information, and this information is like the name and location of extremist martyr suicide bombers. The most vital information has the most demand and the market is constantly being updated with new intelligence which the CIA can trade. Information is supplied by CIA gatherers who drain information from contacts. The nature of the information being traded is such that if the wrong information falls into someones hands it can prove to be deadly.

CIA personnel need intelligence in order to better understand criminals in the world and to try and prevent acts of terrorism. Criminals have no desire to let vital intelligence fall into the hands of the CIA as it can thwart their plans. Criminals incentive not to leak information is that they will be severely punished for doing so. CIA incentives for getting intelligence is if they dont they lose their job.

Information must get traded otherwise it cant be used when it gets old. The role of technology is to allow information to be gathered and stored, for example pictures in digital cameras, and text messages on mobile phones, and this data can be sent on computers via the internet to destinations across the world.

Information is gathered by moles who lie and decieve in order to gain positions of trust, and then abuse these positions by selling the valuable information. In the situation of good versus evil when information contained within a good person has a high demand the evil people will use fear of pain and death by torture in order to extract the information. Similarly fear of imprisonment can provide enough incentive for evil people to divulge their secrets.

Sunday, 7 December 2008

GE/Honeywell case Economic theory

GE/Honeywell case

Economic theory

There are two main points regarding conglomerate effects

1. Financial strength of GE capital

2. Bundling

Below I will set out these points in more detail. Relate the theory to the case, and give examples to help people understand.

Financial power

GE and GE capital have a very large market capitalisation share compared to Rolls Royce and Pratt and Whitney. Financial power allows a firm to engage more in risky investments in order to further the success of the firm, and this is because the firm I less likely to go bust the more financial power it has so it can make more investment mistakes. The ramifications for this for GE is that the firm can engage in risky R&D ventures that P&W and RR cannot afford to risk.

Financial power can be used to attract purchasers of goods, such that financial power can allow greater advertising and promotion which can increase the chances of sales. This means that GE can gain extra sales revenue over RR and P&W which could lead to a reduction in competition in the industry as GE may foreclose its competitors from the market.

Foreclosure

A firm that has greater financial power can essentially vertically integrate with more firms, and this allows the firm to get greater market control which allows it to restrict output and increase prices. For GE this means that the firm can vertically integrate with engine repairers, engine service firms, and replacement parts providers. This reduces competition as RR and P&W have to pay more than GE for engine servicing, repairs and replacement parts which could lead to foreclosure.

Bundling

Bundling is a way that firms can out compete competitors which leads to foreclosure. In an industry with specialist suppliers for the industry to be a success there must be demand across the industry for the specialised products. If a firm only sells one product and it is highly specialised a sudden negative demand shock would severely deprive the firm of profit and lead to foreclosure. A firm with a lot of market power can bundle two or more specialised products together and out compete rivals that can only offer un bundled single product versions. For GE and Honeywell this means that the firms can bundle engines and avionics together to the detriment of RR and P&W. Bundling can take several forms: Mixed bundling is where two or more products are sold together for less money than buying the products separately. Pure bundling is where two or more products are sold together and cannot be purchased separately, and technical bundling is where products in a bundle are not compatible with rival firms’ products. GE and Honeywell through bundling can effectively starve RR and P&W of revenue leading to their market foreclosure, which is worse for consumers in the end as it has an adverse effect on their welfare.

Conglomerate effects: Extending dominance

The Court of first instance (CFI) proposed that GE would extend market dominance into the market for Honeywell through the practice of bundling. I will explain a bit more about this below.

Bolton and Scharfstein (1990), proposed an economic model where financial contracts are observable and firms with deep pockets use financial power to weaken the performance of other firms. When a firm faces competition in many markets it invests heavily in risky R&D projects in the market with the fiercest competition in order to provide rivals with an incentive to stop innovation by cutting R&D funding.

In conglomerates the internal management must deicide upon the re-allocation across the subsidiaries in the merger. The management can decide to use a “winner picking” approach where the majority of funding is channelled towards the most successful firms. The other approach is to “cross subsidisation” which means spreading the funding across the subsidiary firms. This latter approach allows a wider presence to be maintained than the winner picking way as firms have more of a competitive presence across the participating markets. The “winner picking” approach may result in some firms being unable to compete and having to close.

Cestone and Fumagalli propose a winner takes all model of the product market. Firms with the most financial power can engage in R&D spending that smaller firms with less financial power cannot engage in with equal levels of effectiveness. In the model groups of firms compete with more strength than stand alone firms. Even if a stand alone firm spends the same as a group of firms on R&D the benefits will be less effective because it's a stand alone. This means that subsidiary firms related to the group are less likely to be effected by R&D investment made by rivals and so the stand alone firms are more inclined to exit the industry.

The merger would result in the conglomerate charging higher prices for after sales services, but the consumers are rational and can see that the overall cost of the engines and the after sales service for the engine is too high and would have an incentive to shop elsewhere for cheaper deals. Firms know that prices will go up if one conglomerate gains significant market power, the consumer firms realise this and so they have an incentive to promote the interests of rival firms. For the case this means that Boeing and Airbus are likely to want to buy from RR and P&W in order to keep competition alive for the purpose of driving industry prices down.

Theory of Leverage and relation to Kosher certification

The theory of leverage is that a firm can force foreclosure by chosing to buy supplies from the same firm all the time. In the case here it would mean that GECAS would decide to buy all of its engines from GE, and then from Honeywell post merger. When manufacturers decide what to produce they consider the preferences of 1% of the market, given that the 99% are indifferent between products. Kosher is when a Jew has to obey a specific diet by eating only Kosher foods. Kosher Jews prefer to buy Kosher certified foods and will never decide to buy non-Kosher certified foods. Manufacturers know the preferences of one percent of the market as being Kosher and so decide to offer Kosher certified products because the other 99% have no preference as they are indifferent.

The group of Kosher consumers are able to tip the market. Similarly in the case GECAS will only buy from GE, and post merger from Honeywell. GECAS considers a plane to be certified kosher only when all of the parts required to build the plane come from GE and Honeywell. If other buyers in the market have no preferences than there is foreclosure. This happens because suppliers in the industry e.g. airframe sellers know that if they don’t supply GE/Honeywell parts than they sacrifice all of GE/Honeywell business.

Monday, 17 November 2008

Benefits from immigration

Immigrants can have an adverse effect on job opportunities for natives as immigrants skillsets resemble those of native workers but immigration can contribute to a host countries income. This is a standard supply-demand analysis above, as wage falls unemployment increases. Suppose labour supply of native workers is S and the wage is W0. Assume labour supply is inelastic and so equilibrium is at the intersection at point B. National income is the area ABN0. Now there are large inflow of immigrants and the labour supply shifts to S’ and the new wage level is W1. National income increases to ACM0, and total wage paid to immigrants is FCMN. The increase in national income from immigrants is triangle BCF. This is immigration surplus.

Essentially the benefit to the host from immigration is greater than the wage paid to immigrants as the wage is lower for immigrants but productivity of immigrants is equal to productivity of natives. There are benefits to host only when the demand is inelastic and immigrants get paid less, otherwise is demand is perfectly elastic there are no gains

Tuesday, 11 November 2008

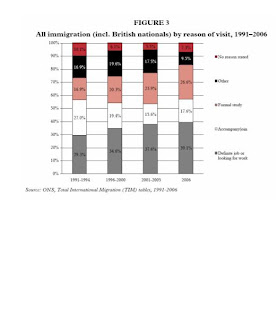

The graph shows that people often accompany others and they migrate together and this is called family migration. When a family migrates economic theory states that they decide to move when there are benefits to the whole family and not individuals.

Saturday, 1 November 2008

Product Differentiation

The demand proximity effect is where firms tend to locate near to the high areas of demand which is where there are most consumers. Suppose consumers are split into two groups of equal size and that the consumers are located so that one group is at one end of the market and the other group is located at the other end of the market. Assume the prices are fixed so competition is purely about location and there are two firms. The firms will locate one at each end of the market, hence firms locate where the demand is, and this is referred to as the demand proximity effect.

Product proliferation is where firms make many different varieties of products and flood the markets with them. The effect of product proliferation can be that the proliferating firms gain a larger share of the market demand from consumers and thus restrict demand for potential entrants. The effect is that firms considering entering the market cannot expect to get enough profits in order to cover their costs and so the potential entrants decide not to enter the market.

For product proliferation to be a credible strategy firms must have sufficiently high sunken costs in order for potential entrants to know it is unlikely for the firms to move location as the costs of moving location are high enough to provide incentives for firms to stay committed to their current locations.

Maximum product differentiation is beneficial to firms as it allows them to capture a greater share of the market, and increases in demand will boost seller’s profits to higher levels than if minimum product differentiation was in place, all other things equal. Consumers get their wants satisfied to a higher degree as there are wider varieties of products giving consumers a bigger choice.

The following two graphs, labelled figure 4 and figure 5, are from a spatial competition experiment by Kruse, Cronshaw and Schenk (1993). In the experiment, firms chose simultaneously where to locate along a line of a set distance. The consumers in the experiment are identical and have downward sloping demand curves, so as prices increase they demand less and likewise if prices fall demand increases, other things equal. The consumers are equally distributed along the line. Consumers will always buy from the firm that is closest to them as it minimises transport costs. Factors like the price are controlled and fixed so the competition is spatial. The firms have to consider two things when chosing where to locate on the line. First, market share and second, proximity to consumers.

The two figures above represent the equilibrium locations shown in figure 4 and figure 5 below. The top figure shows the principle of minimum differentiation because the two firms are located next to each other in a cluster. The result of the clustering is a low level of sales. On the other hand, the bottom diagram is more analogous to maximum differentiation and the sales are higher than in the above diagram as a direct effect of firms producing a wider variety of products which capture a greater market share and produce higher demand which boosts firm’s profits higher than in the top figure.

Telser (1988) comes to the conclusion that in the case of n amount of firms the equilibrium is for firms to be at equi-space distance from each other which is what is represented by the quartile positioning of firms above in the duopoly case. The equilibrium condition depends on transport costs.

Consider two communication cases:

1. No communication

2. Communications are allowed in the spirit of “cheap talk” (Farrell 1987) and sellers can suggest that each would be better off by locating symmetrically away from the centre of the market. Communicators remain anonymous in this experiment through the use of a VAX phone system which renders different voices to be all the same voice and incomparable. The marginal costs are constant and the price is fixed so the firms try to maximise quantity sold by getting the highest possible market share. The principle of minimum differentiation does not always hold when transport costs are sufficiently high.

Sellers locate in the centre as shown in figure 4 because of the failure to co-ordinate due to no communication between firms; however, when communication is allowed there is clearly a co-ordination effort and collusion results. Allowing co-ordination is socially optimal as consumers are located closer to firms so transport costs are smaller than when companies cluster in the centre.

Why do convenience stores tend to locate themselves apart from each other and near to large amounts of consumers? Why do restaurants usually locate close to each other? Why do car dealers chose to locate close to each other but go to great lengths to product differentiate through expensive advertising? Convenience stores maximise sales by locating by large amounts of consumers as these areas have the highest demand. As there is a large distance between rival convenience stores there is a high level of maximum product differentiation and firms sell a large variety or products differing in quality and shape etc. which increases demand and market share thus boosting revenues to the firms.

Saturday, 18 October 2008

Successful approach to Development Economics

Sunday, 12 October 2008

Graduate Scheme (Norwich Union Insurance Group) 30/06/09

Friday, 3 October 2008

Why is economics central to an understanding of the problems of development?

Wednesday, 1 October 2008

Socialism

Monday, 29 September 2008

Industrial organisation pt2

A little bit of price discrimination is a good thing. Monopolists can offer bundling and versioning where by with Microsoft office software packages it is better value for money for consumers to buy a bundle of software instead of buying the software separately.

Saturday, 27 September 2008

Labour Economics pt2

If unemployment decreases by 2% how much production is changed by?

When wages rises by 2% how many people stop working?

When the hours of work are reduced how much money is saved?

I can give examples of normative economics at work too such as these questions:

Should unemployed people get benefits?

Should we take money from the highest earners and give it to the poorest?

Should men and women be paid the same wages?

Should black and white people be paid the same wages?

Should older people be paid more than younger people?

Thursday, 25 September 2008

Household Economics

SE and IE

Labour Economics

Tuesday, 23 September 2008

in the deep

Adam Smith

university costs

Monday, 22 September 2008

textbook industrial organisation

An example of a perfectly competitive market is the agriculture market and the stock market.

Oligopoly example are steel, beer and soft drinks.

Monopolistic competition has a large number of buyers and sellers, easy entry and differentiated products examples are restaurants, furniture. Is this why we get a lot of restaurants that sell tasteless food in the uk? but then there are lots of nice restaurants.

Industrial organisation

Firms are run by employees who do jobs but they only work for wages and so are controlled by incentives. There are share options which are when employees try to increase share prices and if they reach a pre set target they get to purchase shares at the current price in large quantities and keep the profit. it is a monetary incentive because employees respond to incentives but particularly well to monetary incentives. Incentives are called carrots. The office of fair trading regulates competition in the uk. what does the oft do to remedy competition problems? oft can tell the firms off like a headmaster tells of a school pupil and asks them not to do it again. In extreme cases there are jail sentences.

There are many cases for investigation of competition regulation claims but no more than 10% are ever formally completed and I suspect that if more were formally completed it would be more pareto efficient and people would benefit without anyone becoming worse off. Perhaps too much regulation is not a good thing?

near monopolies

Saturday, 20 September 2008

consumer loyalty

Revised definition of recession

Saying for economics

US government rescue plan

Thursday, 18 September 2008

High inflation in the UK

Questions

Why do people buy things from high street shops when they can get the exact same things online but for lower prices?

Why are some people still connected to the internet with dial up when broadband is cheap and readily available in most areas in the country?

Why do grooms rent tuxedos while brides buy their wedding dresses given that the grooms will have many more occassions to use the tuxedos but brides only use their wedding dresses once?

Why are prices for airplane flights so much higher from STA than on the internet for the same flights?

Why do people pay £5 to go to the cinema when they could wait and buy the film on dvd for the same price from ebay?

Why are prices for gas and electricity different from different provider companies when the gas and electricity from the providers is the same?

Economist magazine subscription

Road sign economics

3 great economics works

The wealth of nations-Adam Smith

The general theory-John Keynes

Das Kapital-Karl Marx

Alan Greenspan, one of the most influential figures of the financial universe, has read the General Theory twice.

Lloyds buys HBOS

Keynes online

http://www.marxists.org/reference/subject/economics/keynes/general-theory/